A/P Recurrent Invoices

Used for entering Accounts Payable recurrent (repeating) invoices that occur every month, such as rent, pumper charge, etc… that you do not receive a monthly Accounts Payable invoice for but must be paid monthly. Accounts Payable recurrent transactions have no affect on the Accounts Payable programs until the Accounts Payable Recurrent Transaction file is Appended to the Monthly File.

Using this routine allows you to enter the Accounts Payable recurring transactions into the Accounts Payable Recurrent file. The Accounts Payable recurrent invoices must be appended to affect the Accounts Payable programs and the Transaction file. The invoice number generated must not reside in the Accounts Payable programs. Duplicate invoice numbers will be checked when the invoices are appended to the Accounts Payable programs.

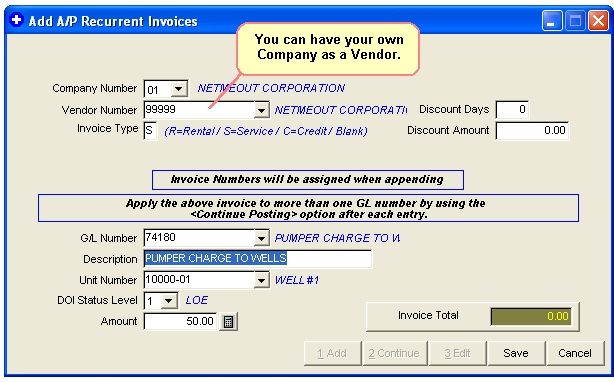

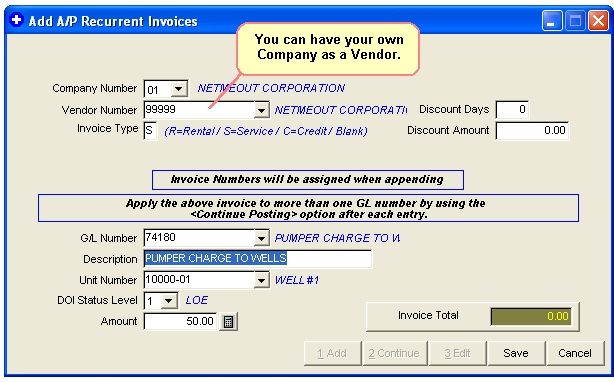

ADD AP RECURRENT INVOICES

Normally used to enter Accounts Payable recurrent invoices that you do not receive a monthly Accounts Payable invoice for. Invoices that have been paid are entered through Transaction file. You will not enter an invoice number, invoice date or transaction date when entering the Accounts Payable recurrent invoices. When the Accounts Payable Recurrent file is appended to Accounts Payable program, you will enter the Transaction date. The Accounts Payable invoice date will be assigned the same date as the transaction date.

This process is very similar to Add AP Invoice discussed in Tutorial.

Select AP - Recurrent Transactions - Add

You are not asked to enter an invoice number, only the invoice type when adding Accounts Payable recurrent invoices. When you append Accounts Payable recurrent invoices to current month, you may use computer assigned invoice numbers to all invoices or scroll to assign invoice numbers. Each transaction associated with this record will be assigned the same invoice number.

Invoices that are to be billed to Investors through Operating Statements should have all three of the following:

1. Unit Number

2. DOI Status Level that reflects the owner percentage to use from the DOI file. Default status of the well from as expressed in the Unit Master file will be reflected on screen as you tab to that field.

3. A GL Number from 71001 to 75999 (billable expenses).

NOTES ON FIELDS FOR ACCOUNTS PAYABLE RECURRENT FILE

VENDOR NUMBER: The vendor this recurrent invoice will be assigned to.

INVOICE TYPE: Must be either an R/S/ or Blank type invoice. R=rental 1099 invoice, S=service 1099 invoice, or Blank=normal invoice. An invoice type of R or S will be added as the last character of the invoice number to computer assigned invoices. As rental or service invoices are paid in the Accounts Payable program, the vendors balance for 1099's will be updated.

DISCOUNT DAYS: Number of days within which you can pay the invoice and receive a discount.

DISCOUNT AMOUNT: This is the actual amount (not percentage) of the discount, if you pay the invoice early (within the specified number of discount days).

GENERAL LEDGER NUMBER: Enter the 5-digit general ledger number for this transaction. The general ledger number must reside in the Company Chart of Accounts. The general ledger number will be a debit for this charge. If invoice number ends with a 'C' type for credit invoice, the general ledger number will be a credit for this expense.

DESCRIPTION: Extra for Operating Statements.

UNIT NUMBER: Normally the well number. If you don't enter a unit number, the transaction is not used when printing Operating Statements.

DOI STATUS LEVEL: Used to indicate which percentage in the Division of Interest file to use for billing the Investors. If no unit number is entered the status defaults to 0.

AMOUNT: Enter the amount to be posted to this record. Multiple posting to the same record will group amounts for invoice total. You can use the calculator button to calculate any value without leaving the program or using a 10 key.

You may assign the invoice number for an Accounts Payable recurrent invoice entry. Multiple posting transactions for the same group will automatically be assigned the same invoice number.

Please note no posting entries are reflected to general ledger account number 21000, Accounts Payable. The posting entries to 21000 for all Accounts Payable recurrent transactions will be automatically posted to the Transaction file when you append.

EDIT/DELETE AP INVOICE

In the edit routine, you are able to edit any record in record order number. You can also delete a record from the edit mode, but the record is only marked for deletion. You must also pack your file to delete it.

Select Transactions - Recurrent Transactions - Edit/Delete

This process works the same as in the normal Edit/Delete for AP Invoice except it works on the recurrent file instead of the actual AP file.

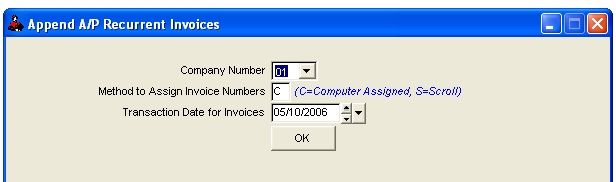

APPEND AP RECURRENT INVOICES

Appending Accounts Payable recurrent will add invoices to the Accounts Payable Detail file. The posting for each invoice will be appended to the Accounts Payable Register file. The debits and credits will be appended to the Transaction file. The vendor’s balance will be adjusted in the Vendor file. The Accounts Payable Recurrent file will be cleared of invoice numbers. New invoice numbers have to be assigned before the file can be appended again.

Select Transactions - Recurrent Transactions - Append

METHOD TO ASSIGN INVOICE NUMBERS

Computer Assigned

For invoices that don't have an invoice number. This method automatically assigns an invoice number by combining the vendor number and the assigned transaction date.

Scrolling to Assign

Displays each invoice that has not been assigned a number, and allows you to assign a number. A sanity check will be performed to check for missing invoice numbers or duplicate invoice numbers in the Accounts Payable Recurrent file and the Accounts Payable Detail file.

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.